What is Forex Trading?

The term “Forex” is an abbreviation for “Foreign Exchange” which is the relative value of a currency when opposed to another currency. With a daily turnover (buying and selling) of up to 5 trillion, the foreign exchange sector is the biggest market in the world!

Many different entities, including banks, big corporations, trading companies, investors and speculators, all take part in the Forex market for a variety of reasons.

Although a speculator can buy and sell positions that aim to make money trading Forex by rapid moves on the market, large corporations could exchange large amounts of money for clients who need to convert their money to another currency. The Forex industry is the highest in the world and is worth up to 5 trillion a day. There is no other industry in the world that is somewhat close to getting this type of trading volume over a 24-hour cycle.

For traders, the forex market is a place where they can make profit either by buying low and sell high or by sell high and buy low. Forex trading for retail speculative traders has not always been available, approximately around 1996 they had the opportunity of start trading. Before that, Forex was the property of either the big corporations or the super-rich. With the arrival of digital technologies and the Internet, Forex become available to all types of traders with the smallest traders being able to trade via cents.

Main features of the Forex Market

- Forex is a 24-hour business.

- Currencies are traded internationally Big financial centres involve Tokyo, New York and London.

- Forex is a very liquid market. liquidity is the option to get fast in and out of the market at a fair market price.

- The Forex market is a fast-moving market, which means that exchange rates will respond fast to key data pieces. In comparison to shares trading, the Forex market is at most a zero-sum gaming.

Where is Forex Located?

There is no single market position or exchange to the Forex trading market. Unlike stocks where each nation has a place of processing, such as the the Australian Stock Exchange (ASX) in Australia, or New York Stock Exchange (NYSE) in the US. Forex is a real global marketplace joined by large banks and their rates. Since Forex has no fixed marketplace or exchange, there is no official regular or 24- hour closing time, although the close of the US market is usually seen worldwide as the Forex market close of the day and the start of the Asian session as the start of the market again.

Who Trades Forex?

The Forex market is traded by a wide range of companies and individuals. Four of the major players on the Forex market are:

- Bank

- Speculators/Retail traders

- Big international firms

- Commercial Firms

You will also encounter a trader called a ‘retail trader.’ It’s an investor who’s speculating on the stocks to try to make money. The speculator is trying to gain from minor price changes. This traders would usually trade via a broker and use leverage to help them open big positions for small outlays.

Margin and leverage are further discussed in section four of this course, so keep reading for more detail.

Who Controls the Forex Market?

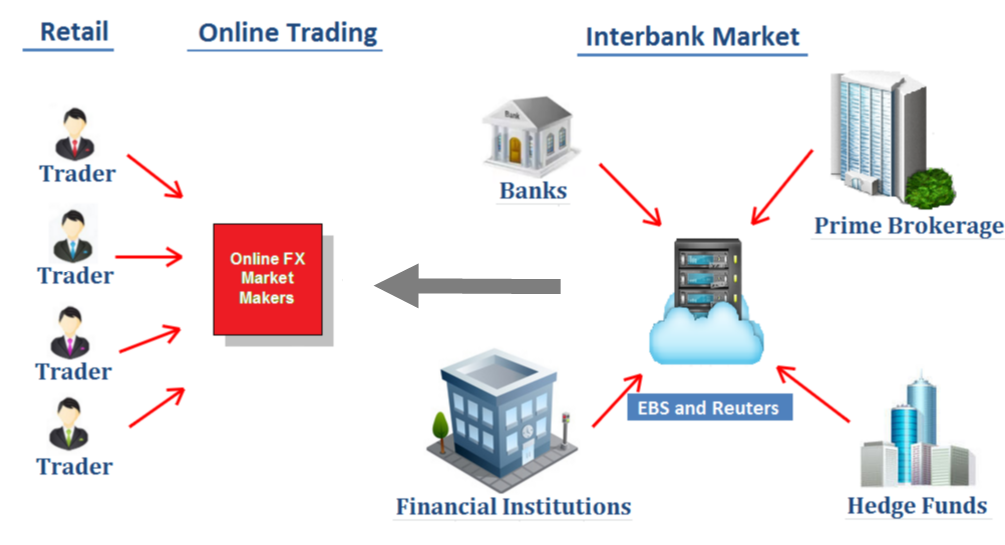

Although there is no centralized exchange for the Forex market, there are several different mechanisms within the Forex market that actually influence Forex rates in one manner or another. There are three types of layers from which Forex trades are facilitated:

- Interbank market where the major banks perform exchanges with each other.

- EBS services that aggregates offers and bids from various banks, but you can also see how big they are able to sell at each level and on other ECN platforms.

- Retail brokers.

The biggest banks in the world are the ones that directly dictate currency exchange rates. According to the latest statistics from 2015, below are the banks with the highest market share in Forex:

- CitiBank with a market share of 16.11%.

- Deutsche Bank with a market share of 14.54%.

- Barclays with a market share of 8.11%.

- JP Morgan with a market share of 7.65%.

- UBS with a market share of 7.30%.

They’re a collective of major banks who pretty much dictate stock rates, and they’re basically market makers. Governments and central banks are institutions that engage in Forex for a variety of different purposes. Some of the main central banks in the world are the ECB (European Central Bank), the Fed (US Federal Reserve) and the BOJ (Bank of Japan). Central banks engage in the forex market for a variety of reasons, such as:

- International trade.

- Control of reserve.

- Interfering in currency rates.

What is Traded in the Forex Market?

You are buying and selling currencies when acting in the Forex market. Currencies are traded in what is known as pairs (more on that later in the course) . The price of each currency is typically a representation of the thoughts of market or market participants regarding the economy of that region. Basically, if the price is rising for US dollars, that’s because the market think the US economy is stronger compared to where the present price is. In other words, the price is cheap.

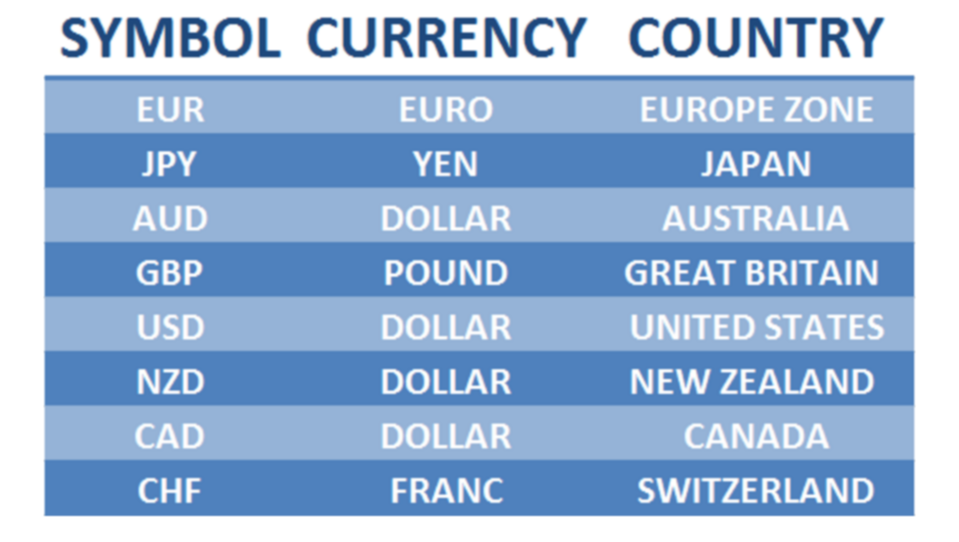

Some major currencies are shown below. Each currency is then given an abbreviation to render its trading symbol. Let’s take the Australian dollar for example, it is turned into a AUD. The AU is for Australia, and the D is for the dollar. Notice the other major currency symbols below.

Why do Exchange Rates Fluctuate?

As for all other asset groups, the exchange rate of the currency pair fluctuates due to the market-driven imbalances between supply and demand ratios. Essentially, if the demand for one specific currency pair is greater than the supply side, that currency pair will increase in price, on the other hand, if the supply for one particular currency pair is greater than the demand side, that currency pair will decrease in price. The exchange rates will decrease and increase until the level of supply and demand is balanced again.

- monetary policies

- of the Central Banks

- Differential interest rate

- the inflation rate

- Current account deficits

- Public debt

- Political prosperity and geo-political stability

How to Make Profit from Trading?