How to Use Sell Limit and Sell Stop Order – Explained With Examples

In this tutorial, we’re going to learn about sell limit and sell stop and how use them and execute an order on your trading platform. However, in order to learn about sell stop and sell limit, we first need to understand what is a market order.

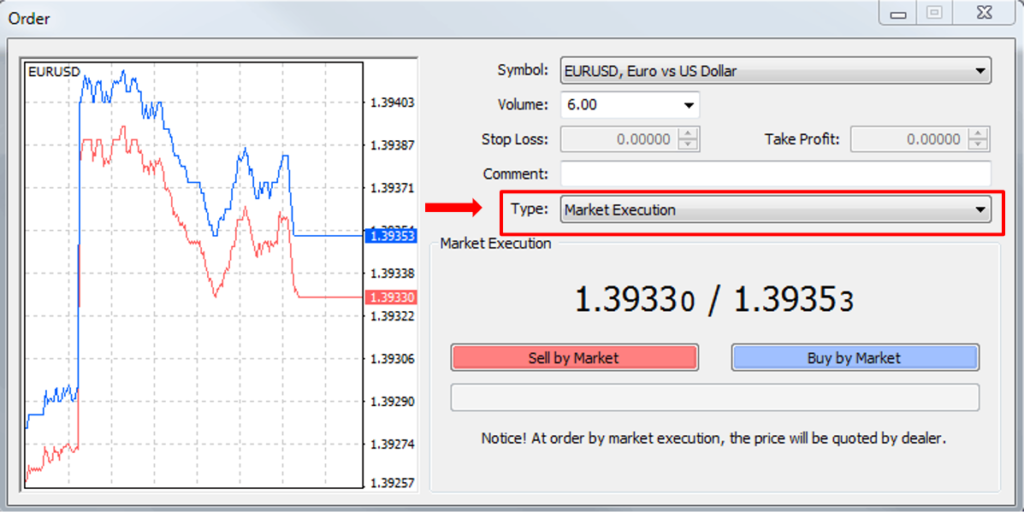

Market Orders

Once place a market order, we actually place a Sell or Buy order for entering at the best possible price. An example of this could be; you enter a market order to buy XYZ which has a bid price of 1.3512 and ask of 1.3514. After your buying order has been placed, XYZ will be sold to you at 1.3514. See the image below that demonstrate a market order on MT4 platform.

You will need to bear in mind that you’re not necessarily going to enter the same price you were quoted before you press buy or sell. Based on the market conditions, for example, when news is published and the market is extremely volatile, probably you’ll get a different price.

What is a Sell Limit and Sell Stop Entry Order?

By placing a sell limit or sell stop entry order, you are placing an order to sell above, or below, the current price. An example might be:

Suppose you are interested in trading the ABC / XYZ pair, but only if the price moves lower. You can choose between two options:

Wait to see if the price moves lower, and if it does, enter a market order to buy. Alternatively, you could set a sell stop order so that if the price moves lower and into the level you want to enter, it will automatically be entered.

How to use Sell Limit and Sell Stop Orders?

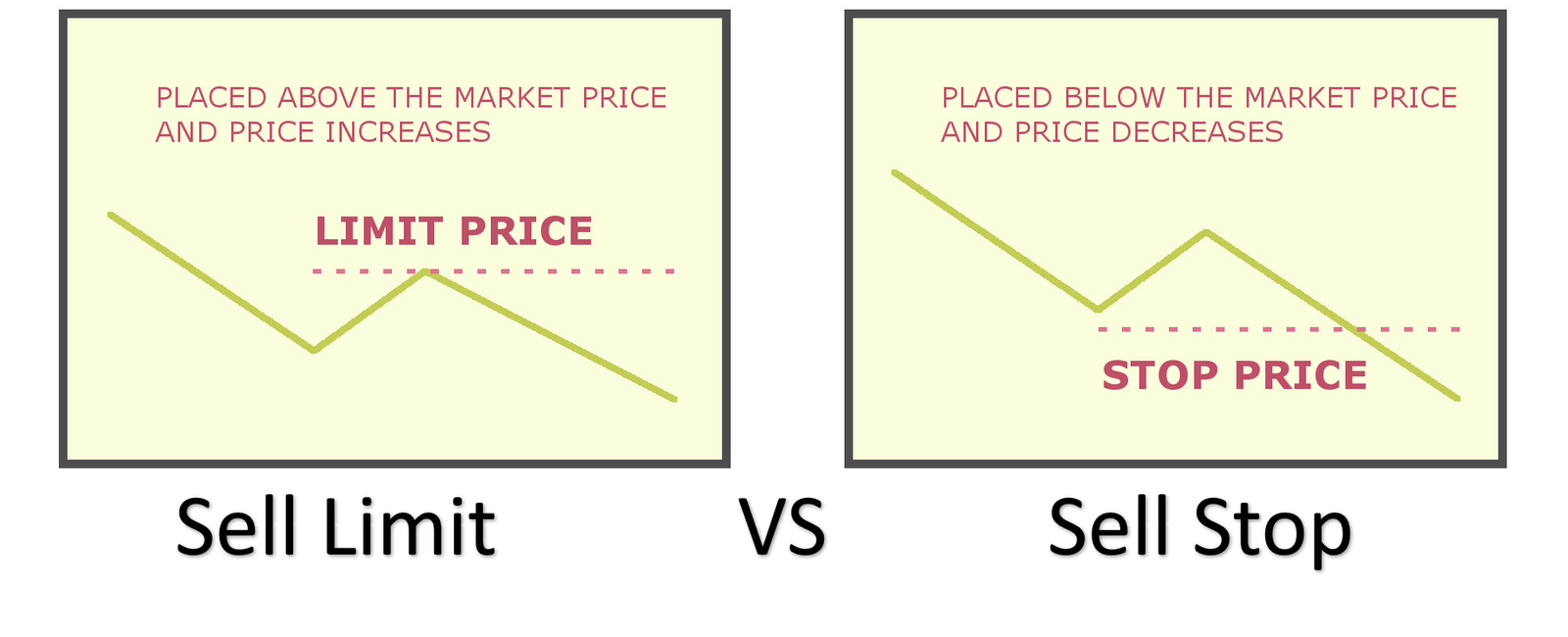

Sell Limit

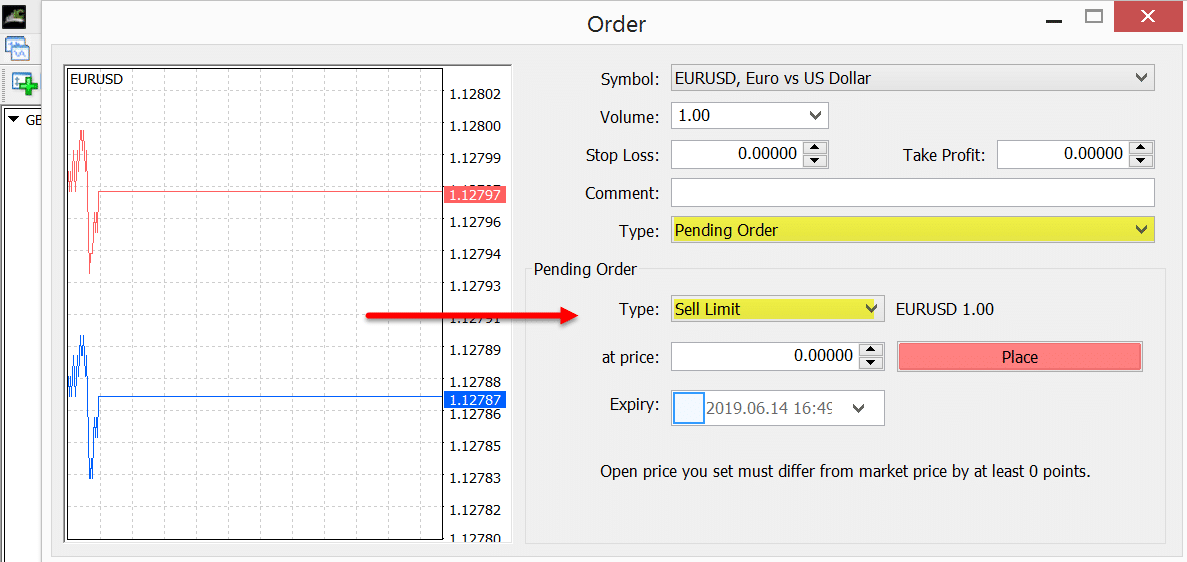

In a sell limit order, you place an order to sell above the current market price. For example, ABC / XYZ pair are trading at 1.3210 and you wish to sell when the price reaches 1.3220. You might want to set a sell limit so that if price moves higher to 1.3220 a short trade would be triggered.

Let’s see how to create a sell limit order on MT4:

Buy Stop

Buy stop orders are orders that are entered if the price moves above the current price. Breakout traders and traders using a pyramiding system frequently use buy stop orders to create larger winning trades.

Suppose you want to go long and buy ABC/XYZ pair, which is currently trading at 1.3510, but only if it moves higher to 1.3530. By setting a buy stop order, you will be entered into a long position if price moves higher and into the 1.35 price.

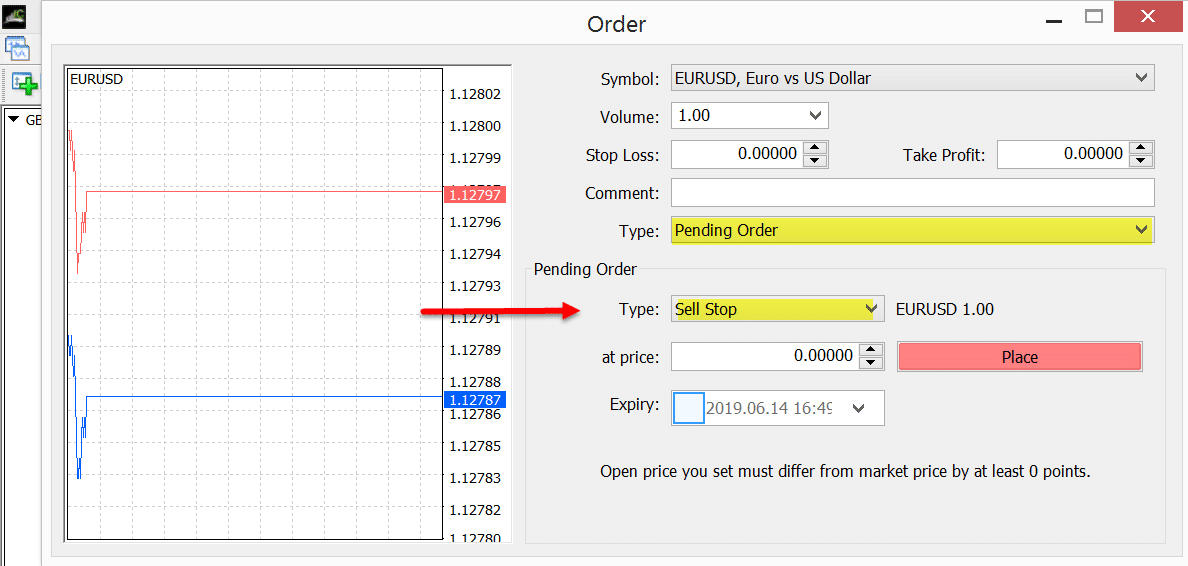

Let’s see how to create a Sell Stop order on MT4:

Similar to a buy stop order, it can be used if you think the price is going to continue in a certain direction. A breakout trader seeking a level to quickly break and traders using a pyramiding entry method commonly use these entry types.

Let’s see how to create a Sell Stop order on MT4:

- Open the relevant MT4 / MT5 charts.

- Click tools >> New Order button.

- Under the ‘symbol’ drop-down list, choose the currency pair you want to trade.

- Under the order ‘Type’ dropdown select ‘Pending Order’.

- You will be presented with 4 options:

- Buy Limit – Order to go long a level lower than current market price

- Sell Limit – Order to go short at a level higher than current market price

- Buy Stop – Order to go long at a level higher than current market price

- Sell Stop – Order to go short at a level lower than market price

- Next, enter the price you want to pending order to get triggered.

- Enter the size of your position in the volume field.

- Fill in the stop loss and take profit fields (Optional if needed).

- Once you are happy and it is all filled out, click the ‘Place’ button to enter your trade.

Recap

In a sell limit order, you set a minimum price for selling a stock. It’s a trader’s way of being a good negotiator. Whenever you are making a deal, you won’t say, “I will sell for whatever the going rate is.” You find out what the going rate is, then raise it to what you think the market can bear. By doing so, you can ensure the deal you make is one you’re happy with.

In a sell stop order, you can set a price that is below the current price of the pair. In the event the stock drops below your stop price, a sell limit order is triggered.

Here are the main differences between Sell Limit and Sell Stop:

- You use a Sell Limit to set a higher price where you want to secure profit, While using a Sell Stop in order to set a price lower than the market price to minimize loss.

- in Sell Limit, if the price reaches the limit price, there is an assumption that the price will continue to rise. By selling at the limit price or higher, profit can be guaranteed. While in Sell Stop if the price drops at the stop price, there is an assumption that the price will continue to fall. By selling at the stop price, the loss is capped or minimized.